Are Cares Act Unemployment Benefits Taxed

For a Michigan resident any unemployment benefits including the extra weekly 600 received through the CARES Act that are included in federal adjusted gross income are subject to tax in Michigan. In addition unemployment compensation provided through the federal CARES Act and subsequent extensions is exempt.

Affordable Care Act Aca Compliance Examined The Treasury Inspector General For Tax Administration Tigta Reported That The I Financial Help Irs No Response

Unemployment benefits are generally treated as income for tax purposes.

Are cares act unemployment benefits taxed. The CARES Act changed that and the recent stimulus bill signed into law December 27th extended the benefits. Unemployment benefits including the extra weekly 600 received through the CARES Act must also be included in a claimants Total Household Resources. The Coronavirus Aid Relief and Economic Security Act also known as the CARES Act is a 22 trillion economic stimulus bill passed by the 116th US.

This meant that many of your clients who received unemployment benefits in 2020 may have been eligible for a refund from the IRS. In late May the IRS started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on that money before the American Rescue. Expanded Unemployment Benefits Under the CARES Act TaxAct.

Alabama does not tax unemployment benefits. Taxable benefits include any of the special unemployment compensation authorized under the Coronavirus Aid Relief and Economic Security CARES Act enacted this spring. Because unemployment benefits are considered income youll need to report them on your 2020 federal and state as applicable taxes when you file your return in early 2021.

The federal 600 weekly unemployment benefit. The latest version of the 19 trillion federal coronavirus. Unemployment benefits Under the CARES Act eligible Americans who are out of work entirely or underemployed because of reasons related to.

The federal government will issue Form 1099-G which reports the amounts paid to you. The legislation excludes only 2020 unemployment benefits from taxes. Most beneficiaries will receive nearly 1000 in weekly combined federal and state benefits until July 31 2020.

The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable. Generally a self-employed person is not able to claim unemployment benefits. The federal government considers unemployment benefits to be taxable income although taxes are not automatically withheld from benefits payments the way an employer might take taxes.

The legislation signed on March 11 allows taxpayers who earned less than 150000 in modified adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly and 10200 for all other eligible taxpayers. Because a self-employed person usually cant claim unemployment the issue of whether or not their unemployment benefits are self-employment income has not been addressed that I can. The American Rescue Plan Act of 2021 which most people call the stimulus.

Congress and signed into law by President Donald Trump on March 27 2020 in response to the economic fallout of. State Taxes on Unemployment Benefits. Tax refunds on unemployment benefits.

That means the first 10200 of unemployment insurance will not be taxable -- so if someone received 20000 in benefits in 2020 they would only be taxed. Offers a tax break on some unemployment benefits received in 2020. By law unemployment compensation is taxable and must be reported on a 2020 federal income tax return.

Before 2021 unemployment benefits counted toward your income and were taxed at rates according to the IRSs tax brackets. Under the American Rescue Plan the first 10200 of unemployment benefits received in 2020 is not taxable if annual income was less than 150000. Covid bill waives taxes on up to 20400 of unemployment benefits for married couples.

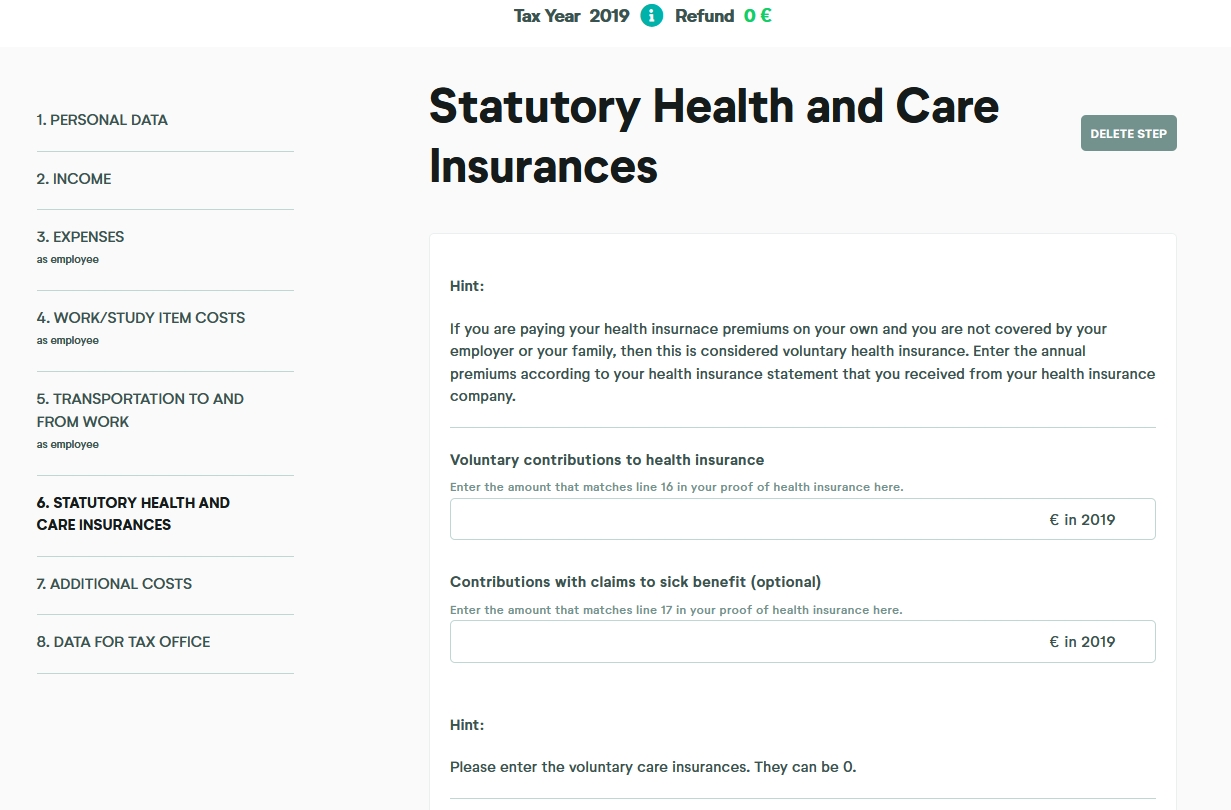

Your Bullsh T Free Guide To Taxes In Germany

Your Bullsh T Free Guide To Taxes In Germany

Income Tax In Germany For Foreigners Academics Com

Don T Forget Unemployment Benefits Are Ta2020 06 09 Dont Forget Unemployment Benefits Are Taxable Tax Debt Bookkeeping Business Business Tax

Your Bullsh T Free Guide To Taxes In Germany

A Full Step By Step Guide Helpcenter

S Corps 4 Big Red Flags That Will Trigger An Irs Audit Century Accounting Financial Servic Small Business Tax Business Tax Bookkeeping Business

Mandatory Tax Assessment Who Has To File A Tax Return

Tax Season Is Not Over Until You File Tackk Tax Season Tax Services Tax

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Post a Comment for "Are Cares Act Unemployment Benefits Taxed"