Iowa Car Registration Fees Calculator

For tax years 2008 and earlier pickup truck registration fees could not be taken as an itemized deduction because the fees were structured as a flat fee and were not based on value. All vehicles must be registered to legally be driven in Iowa.

Dmv Fees By State Usa Manual Car Registration Calculator

Some states may require you to pay an additional registration fee if you own an electric vehicle or a hybrid.

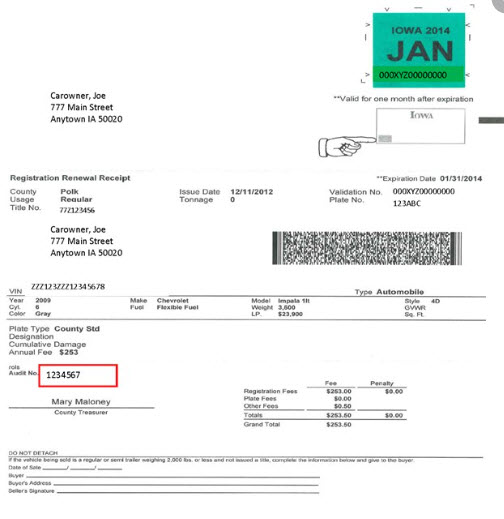

Iowa car registration fees calculator. In addition to taxes car purchases in Iowa may be subject to other fees like registration title and plate fees. Registration Fees Iowa Code 321109 321115 Through 321123. The annual registration fees are determined by Iowa Code sections 321109 and 321115 through 321124 and are to be paid to the county treasurers office in the county of residence.

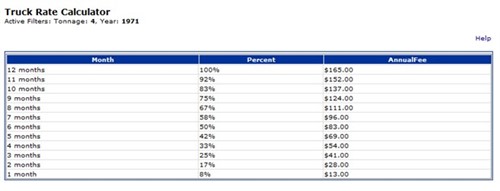

Find the bold FEB go down that column to MAY and find 33. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. Iowa Documentation Fees.

Car Registration Calculator Iowa. Iowa dealers were able to issue 90-day temporary tags from September 1 2020 thru May 2 2021. Bonded certificate of title.

Check the history of a vehicle. Find the bold FEB go down that column to SEPT and. From there the rate is calculated based on the assessed value.

All vehicles must be registered to legally be driven in Iowa. These fees are separate from the taxes and DMV fees. Registration fees in Iowa are based upon the price and weight of the vehicle.

Review your states car registration requirements. Registration fees for used vehicles that will be purchased in CaliforniaDisregard transportation improvement fee TIF generated for commercial vehicles with Unladen Weight of 10001 pounds or greaterThese vehicles are exempt from paying the TIFThe vehicle registration fee calculator. Under Registrating a Vehicle Click on Fee Calculator Hover over Tools then Dealer Inquiry Select Weight and List Price Calculator and Enter either a VIN or YearMakeModel for fees.

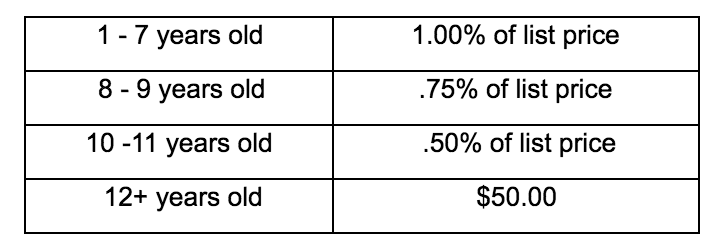

Vehicle registration in Iowa must be done in person at your local treasurers office. 280 per 100 of assessed value for new vehicles and 289 per 100 for used vehicles. Bring your vehicle title drivers license an odometer statement a damage disclosure statement if applicable and payment for your required fee.

When you click on the website link Fee Estimator Worksheet at the bottom of the page you will be a Motor Vehicle Guest. For The State Of Iowa Vehicle Registration Fees Do - TurboTax Support. 30000vehicle First year504Second year43567Third year36487 18000vehicle.

If the annual fee is 242 the 00 prorated amount is 7986 or 8000. Oregon has the highest registration fees in the US. Find vehicle registration fees on the Iowa Department of Transportation page.

Contact your DMV or state motor vehicle registration agency. Verified 4 days ago. Often registration fees or at least the factors that go into determining them are included.

Vehicle purchased in February and customers registration month is September. Can you deduct car registration fees in Iowa. Between 26850 and 63650.

Calculate Your Transfer FeeCredit. The Iowa DOT fee calculator is NOT compatible with Mobile Devices smart phones. To Prove A Transfer Of Ownership Though The Iowa DOT Doesnt Specifically Require This For Vehicle Registration.

Generally these forms outline what you have to pay and why. THE IOWA DOT FEE ESTIMATOR IS NOT COMPATIBLE WITH MOBILE DEVICES SMART PHONES. Upon purchase of a motor vehicle from a dealer you may display a temporary tag for registration up to 45 days or until you obtain and install permanent plates.

Look at the registration application form. This will help you to determine registration fees registration fees remaining on a vehicle that has been sold traded or junked estimate fees due on a newly acquired vehicle. Calculate My Fees - California DMV.

Vehicle purchased in February and customers registration month is May. Use the following worksheet to calculate the deductible amount of annual registration fees paid in 2019 for qualifying automobiles and multipurpose vehicles model year 2009 or newer. For help you can.

Iowa collects a 5 state sales tax rate as a One-Time Registration Fee on the purchase of all vehicles. The annual registration fees are determined by Iowa Code sections 321109 and 321115 through 321124 and are to be paid to the county treasurers office in the county of residence. Click the following link to determine registration fees registration fees remaining on a vehicle that has been sold traded or junked estimate fees due on a newly acquired vehicle and calculate truck fees by tonnage.

Dealers should only be issuing 45-day temporary tags as of May 3 2021. If you itemize deductions a portion of the automobile or multipurpose vehicle annual registration fee you paid in 2019 may be deducted as personal property tax on your Iowa Schedule A line 6 and federal form 1040 Schedule A line 5c. Registration Fees by Vehicle Type How much is tax title and license on a car in Iowa.

Reconstructed and homebuilt vehicles. Showing 1 - 294 of 294 Results. Average DMV fees in Iowa on a new-car purchase add up to 354 1 which includes the title registration and plate fees shown above.

While some registrations pay standardized fees others have weight- and price-based fees.

Income Tax Returns And Your Vehicle Registration Deductible Polk County Iowa

Https Www Iowadot Gov Mvd Ovs Ctmanual Memos Dealer Faq Ert Pdf

Iowa State Sales Tax Guide Tax Guide Sales Tax Tax

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Registration Fees By Vehicle Type Iowa Tax And Tags

Indiana State Sales Tax Overview Indiana State Sales Tax Tax Guide

Bremer County Iowa Enjoy Online Payment Options For Your Convenience

Iowa Car Registration Everything You Need To Know

Vehicle Fee Estimator Polk County Iowa

Iowa Car Registration Everything You Need To Know

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Post a Comment for "Iowa Car Registration Fees Calculator"