Is Long Term Care Insurance Deductible In 2020

IRS Issues Longterm Care Premium Deductions for 2020 Dec 16 2019 The Internal Revenue Service IRS has announced the amount taxpayers can deduct from their 2020 income as a result of buying longterm care insurance. The credit amount cannot exceed 1500.

Comprehensive Overview Of Catastrophic Health Insurance Plans Catastrophic Health Insurance Health Insurance Plans High Deductible Health Plan

The deduction of tax qualified long-term care insurance policies was increased for 2020.

Is long term care insurance deductible in 2020. If one is a business owner the above mention formula may be used on Schedule C to determine the deduction allowable as an amount paid for health insurance premiums4. However you need to check if your newly purchased long-term care insurance policies offers indeed the tax deductible opportunity. The 2020 Tax Deductible Limits for Long-Term Care Insurance.

Premiums for qualified long-term care insurance policies see explanation below are tax deductible to the extent that they along with other unreimbursed medical expenses including Medicare premiums exceed 75 percent of the insureds. The Internal Revenue Service IRS has announced the amount taxpayers can deduct from their 2020 income as a result of buying long-term care insurance. Long-term Care Insurance Premiums paid for a qualified long-term care insurance contract are deductible as medical expenses subject to an annual premium deduction limitation based on age as explained below to the extent they along with other medical expenses exceed 75 of AGI.

More than 70 years old. However the tax-deductible limit still applies. The cost of a long-term care insurance policy is relatively low when youre young so the IRS adjusts the premium deductions based on age.

Those who are self-employed or own an LLC S Corp or C Corp have more extensive deductions. If youre receiving payments on a periodic or per diem basis the limit is 380 for each day for the 2020 tax year. Only if it is Tax Qualified.

According to IRS Revenue Procedure 2019-44 a couple age 70 or older who both have the right kind of long-term care insurance policy can deduct as much as 10860 in 2020. However some policies pay a cash amount or indemnity once you qualify for benefits. If you were self-employed and had a net profit for the year you may be able to deduct as an adjustment to income amounts paid for medical and qualified long-term care insurance on behalf of yourself your spouse your dependents and your children who were under age 27 at the end of 2020.

Individual taxpayers are allowed to deduct the cost of their policy and that of their spouse as part of their medical expense deduction to the extent that their medical expenses exceed 10 of their adjusted gross income. The tax-free maximum allowable amount for 2020 is 400 a day or the actual cost of care whichever is higher. According to IRS Revenue Procedure 2019-44 a couple age 70 or older who both have the right kind of long-term care insurance policy can deduct as much as 10860 in 2020.

Ask for our Tax Guide. Tax-Qualified Long-Term Care Insurance benefits are generally tax-free. FOR CLAIMS IN 2020 with a cash benefit or indemnity per diem policy the minimum tax-free benefit increases to 380 per day 11558month.

This is a 10day increase from 2019 which was 370day LTC insurance benefits received on an indemnity per diem basis are tax-free to the GREATER OF 380day 2020 OR your actual expenses paid for care if greater. Long-term care insurance policy benefits are intended to be tax-free The benefits you receive from a tax-qualified long-term care insurance policy are intended to be tax free as long as they do not exceed the greater of your qualified long-term care daily expenses or. The Internal Revenue Service just announced the increased limits for tax deductibility of long-term care insurance premiums.

According to the American Association for Long-Term Care Insurance AALTCI a self-employed person can deduct 100 percent of their long-term care insurance expenses in 2020. A couple age 70 or older who both have the right kind of long-term care insurance policy can deduct as much as 11280 in 2021an increase of. You can deduct any excess over 380 as a medical expense if you meet the AGI floor requirement for medical deductions.

6 rnduri Is Long Term Care Insurance tax deductible in 2020. If the amount you pay exceeds the limit you cant deduct. Between 60 and 69 years.

Additional information Form CT-249 Claim for. The allowable credit is 20 of the premiums paid during the tax year for the purchase of or for continuing coverage under a qualifying long-term care insurance policy. Thus the long-term care insurance deduction can be considered a retirement subsidy.

The 2019 limit is 10540. For the 2020 tax year your long-term care insurance premium tax deduction maximum is. C-corps may be able to ignore the IRS formula and deduct 100 of the long-term care insurance premium on Schedule CThere may be other situations in which the payment of LTCi.

If you receive more than 380 for each day of long-term care you may be eligible to deduct the excess. The 2019 limit is 10540. Linked Benefit LTCi not tax-deductible.

Employee Health Insurance In 2021 Health Insurance Employee Health Health Savings Account

Long Term Care Insurance Costs Compare Quotes From Leading Long Term Care Insurance Companies

The Tax Deductibility Of Long Term Care Insurance Premiums

Is Long Term Care Insurance Tax Deductible Breeze

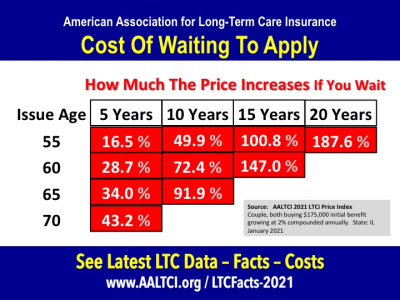

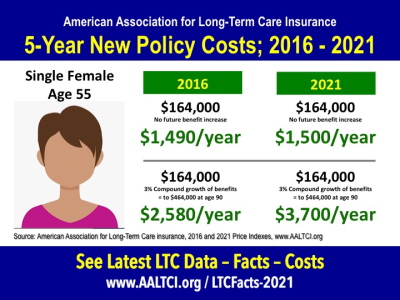

2021 Long Term Care Insurance Statistics Data Facts

2021 Long Term Care Insurance Statistics Data Facts

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

What Is An Hsa Health Savings Account Tax Free Investments High Deductible Health Plan

2021 Long Term Care Insurance Statistics Data Facts

Expat Health Insurance In The Netherlands Zorgwijzer

7 Tips For Choosing A Healthcare Plan Healthcare Infographics Healthcare Plan Health Plan

Pin By Jen Adelman On Marketing In 2020 Long Term Care Insurance Insurance Sales Life Insurance Policy

Big Health Coverage For Small Business Health Insurance For Small Business Owners In In 2020 Affordable Health Insurance Health Insurance Plans Best Health Insurance

Have You Recently Experienced A Significant Change In Your Life Such As Having A Baby Marketplace Health Insurance Health Insurance Coverage Health Insurance

Pin By Investopedia Blog On Finance Terms Payroll Taxes High Deductible Health Plan Health Savings Account

Post a Comment for "Is Long Term Care Insurance Deductible In 2020"