Is Long Term Care Insurance Deductible In 2019

The waiting period on a long-term care insurance policy is kind of like a deductible on your home or auto insurance except it is a number of days rather than dollars. In the last two years that amount was 7.

The Tax Deductibility Of Long Term Care Insurance Premiums

Long-Term Care Insurance has attractive tax treatment under IRC 7702 b.

Is long term care insurance deductible in 2019. Premiums for qualified long-term care insurance policies are tax deductible to the extent that they along with other unreimbursed medical expenses including Medicare premiums exceed 10. The Internal Revenue Service IRS has announced the 2019 tax deduction schedule for Long-Term Care Insurance. This is only available to tax-qualified health-based long-term care insurance policies.

Premiums paid for a qualified long-term care insurance contract are deductible as medical expenses subject to an annual premium deduction limitation based on age as explained below to the extent they along with other medical expenses exceed 75 of AGI. As long as the benefits you receive from your tax-qualified LTCI policy do not exceed the greater of your qualified long term care daily expenses or the per-day limitation of 370 2019 limit your benefits should be tax-free3 SECTION 125 CAFETERIA PLAN Long term care insurance is not allowed in a cafeteria plan. A couple age 70 or older who both have the right kind of long-term care insurance policy can deduct as much as 10860 in 2020.

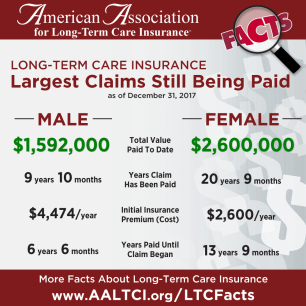

Long-term Care Insurance. According to the American Association for Long-Term Care Insurance AALTCI a self-employed person can deduct 100 percent of their long-term care insurance expenses in 2020. In comparison the tax year 2019 limit was 10540.

For 2020 the LTC or Long Term Care insurance deduction limits changed. Other sessions discussed public options for long-term care coverage such as pending legislation in Washington State to create a social insurance benefit of 36500. The following are the just announced 2019 limits.

Basically its the period of time before benefits kick in after the need for care is established. Many insurance executives who. The allowable credit is 20 of the premiums paid during the tax year for the purchase of or for continuing coverage under a qualifying long-term care.

The 2021 deductible2021 tax deduction limits for long-term care insuranceAttained age before close of tax year 2020AgeDeduction Limit40 or less450More than 40 but not more than 50850More than 50 but not more than 601690More than 60 but not. Self-Employed Tax Deductions. According to IRS Revenue Procedure 2019-44 a couple age 70 or older who both have the right kind of long-term care insurance policy can deduct as much as 10860 in 2020.

Qualified long-term care insurance premiums are tax deducible as long as they along with other unreimbursed medical costs do not exceed a certain amount of your adjusted gross income. The Internal Revenue Service IRS is increasing the amount taxpayers can deduct from their 2019 income as a result of buying long-term care insurance. The 2019 limit is.

A substantial sum still to have for savings but a third as much coverage for long term care. The situation is different when you compare it to that of an eligible 45-year old married man who would pay 88 a month for the same policy and would receive only 41507 in a mutual fund by age 65. Premiums can be tax deductible if you have enough medical related deductions you are self-employed or own an LLC S-Corporation or C-Corporation.

Long-term care insurance can have some tax advantages if you itemize deductions especially as you get older. 2019 Tax Deductible Limits Long-Term Care Insurance According to AALTCI premiums paid for traditional long-term care insurance are includable in the term medical care. When youre self-employed your taxes work differently than if you were an individual working for a company.

Long Term Care insurance premiums can be tax deductible- IRS increases 2021 tax deduction limits for long-term care insurance. These insurance policies have attractive tax treatment under IRC 7702b. Attained Age Before Close of Taxable Year 2019 Limit.

The Internal Revenue Service IRS is increasing the amount taxpayers can deduct from their 2019 income as a result of buying long-term care insurance. Premiums for qualified long-term care insurance policies see explanation below are tax deductible to the extent that they along with other unreimbursed medical expenses including Medicare premiums exceed 75 percent of the insureds. The IRS has clarified the tax treatment of.

6 rnduri Long Term Care Insurance Tax Deductible the details. The federal and some state tax. Premiums can be tax deductible if you have enough medical related deductions you are self-employed or own an LLC S-Corporation or C-Corporation.

The IRS has increased the amount of income taxpayers can deduct in 2019 if theyve purchased long-term care insurance.

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

Tax Deductible Long Term Care Insurance Tax Limits Ltc Federal Tax Limits State Deductions For Long Term Care

Income Tax Deductions List Fy 2019 20 List Of Important Income Tax Exemptions For Ay 2020 21 Tax Deductions List Tax Deductions Income Tax

Is Long Term Health Insurance A Tax Deduction 2019 Insurance Insurancecost Healthinsura Long Term Care Insurance Health Insurance Cost Insurance Comparison

2021 Medicare Costs Premiums Deductibles Irmaa Medicare Financial Information Cost

The 6 Types Of Itemized Deductions That Can Be Claimed After Tcja Deduction Inherited Ira Standard Deduction

2021 Long Term Care Insurance Statistics Data Facts

Tax Deductible Long Term Care Insurance Tax Limits Ltc Federal Tax Limits State Deductions For Long Term Care

Stand Alone Health Insurers Incurred Claims Ratio 2019 Data Health Insurance Companies Health Insurance Best Health Insurance

How Do You Know Which Deductible Is Right For You Consider These Three Factors Read The Full Article On Our Eri Deduction Erie Insurance Insurance Deductible

Health Insurance Costs Surpass 20 000 Per Year Hitting A Record Health Insurance Insurance American Family Insurance

Tax Deductible Long Term Care Insurance Tax Limits Ltc Federal Tax Limits State Deductions For Long Term Care

How A Deductible Works For Health Insurance

Tax Deductible Long Term Care Insurance Tax Limits Ltc Federal Tax Limits State Deductions For Long Term Care

Tax Deductible Long Term Care Insurance Tax Limits Ltc Federal Tax Limits State Deductions For Long Term Care

Post a Comment for "Is Long Term Care Insurance Deductible In 2019"